On Air Now

Early Breakfast with Lindsey Russell 4am - 6:30am

6 July 2020, 12:05 | Updated: 6 July 2020, 12:07

The Money Saving Expert has said families shouldn't take payment holidays unless they need them.

Martin Lewis has issued a warning to everyone taking a payment holiday during the coronavirus pandemic.

Last month it was announced that payment holidays for mortgages, credit card borrowing, payday loans and car finance will be extended until October 31st.

But while this is set to help millions of people across the UK, Martin appeared on This Morning to explain what this really means for those who are struggling financially.

Speaking to Holly Willoughby and Phillip Schofield, the Money Saving Expert explained that a payment holiday just means a deferment of payment, while interest will still rack up.

He said: “Payment holiday is confusing so I’ll take it back to basics, it means you can defer paying for a product and you temporarily don’t have to make that payment.

Read More: Martin Lewis sparks concern he has coronavirus as he reveals he's 'nauseous and weak'

“These have already been in place for years, but regulator FCA put in place specific rules during the pandemic.”

He went on to warn: “You don’t want to take a payment holiday unless you really need it. As I always say, if you don’t need it, don’t do it.

“But then it is far better than not being able to feed your family.”

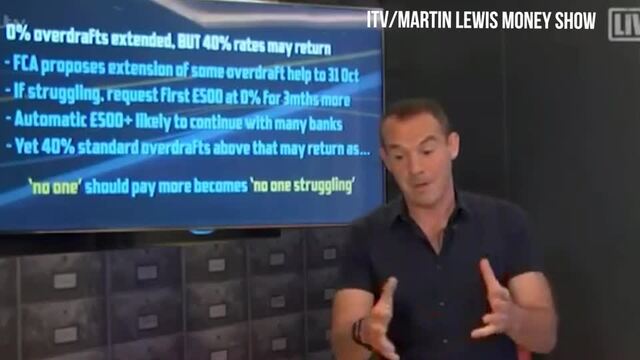

Martin Lewis issues overdraft warning

Using an example, he continued: “Say you’re paying £700 a month on a mortgage and take a six month mortgage holiday, this means you will have 19 years and 6 months left on your mortgage.

“It would increase your monthly payment from £700 to £725 when you started paying again.

“But the less time you have left on your mortgage and the bigger the mortgage, the more effect it will have.”

When it comes to credit cards and other loans, these interest rates tend to be higher, so by not paying, the payment starts to build up.

Martin Lewis gives Heart listeners holiday advice

Martin advises taking a bigger payment holiday on your mortgage and using any extra cash to pay off credit cards.

This comes after Martin previously revealed that lenders will be able to see whether you have taken a payment holiday when you are applying for money in the future.

Despite the FCA claiming this would not be visible on your credit file, other mechanisms can be used to spot the details which can affect your ability to get another loan.

You can get a payment holiday by simply talking to your lender, and if you already have one, just ask for another three months.

You can also now ask for a partial payment holiday which means you can pay back some of it but not all.

Now Read: Martin Lewis issues urgent warning to anyone currently in their overdraft