On Air Now

Heart Breakfast with Jamie Theakston and Amanda Holden 6:30am - 10am

26 June 2020, 11:28 | Updated: 26 June 2020, 12:28

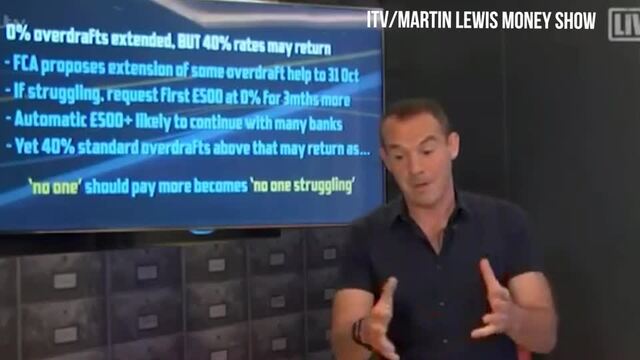

Martin Lewis issues overdraft warning

As the UK eases out of lockdown, Martin Lewis has given an update on overdraft charges.

Martin Lewis has been helping us through the pandemic with his life-saving financial advice.

And appearing on the latest episode of The Martin Lewis Money Show, the money expert was back with a stark warning for anyone currently using their overdraft.

Speaking live from his London home, Martin warned of changes to interest rates which may be about to rise sharply in the coming weeks.

Back in May, the Financial Conduct Authority (FCA) announced a bailout package for millions across the UK struggling to cope with the impact of the coronavirus.

This allowed people to take a three month payment holiday from credit card, loans and mortgages if they had suffered a loss of earnings due to the pandemic.

Banks and building societies were also instructed to offer £500 interest-free overdrafts and were banned from charging high fees.

But as the UK slowly eases out of lockdown, these rules will soon be changing, meaning banks can raise interest rates once again.

Speaking to ITV viewers, Martin said: "40% rates are coming back, I'm afraid."

Earlier this year, the FCA banned all extra charges on overdrafts except interest rates, which meant banks were able to raise their overdraft rates to 40%.

While this change would have happened in April, the plans were delayed, with Martin explaining: "They now have to charge you an interest rate - and all banks seem to have rocketed their interest rates to a 40 per cent standard.

Read More: Martin Lewis issues urgent warning for British holidaymakers about their passports

"That is double a high street credit card. A total danger debt. You are better to clear your overdraft and use that money to clear your credit card.”

While people who are still struggling during the pandemic are protected from this, everyone else will have to start paying the huge rates.

Martin Lewis issues important advice to the self-employed

He added: "When the first coronavirus help came, what they said was 'no one should be charged more’.

"But they've changed it to 'no one who is struggling should pay more'."

Martin added that help is still available, as he explained on his website: "In April the regulator introduced up-to-£500 interest-free overdrafts for 3months - under the new proposals, these will be extended.

"For those struggling due to coronavirus, on request, the first £500 of authorised overdrafts can be interest-free for a further 3months.

"If you've not yet asked for help, you'll have till 31 October to do so."