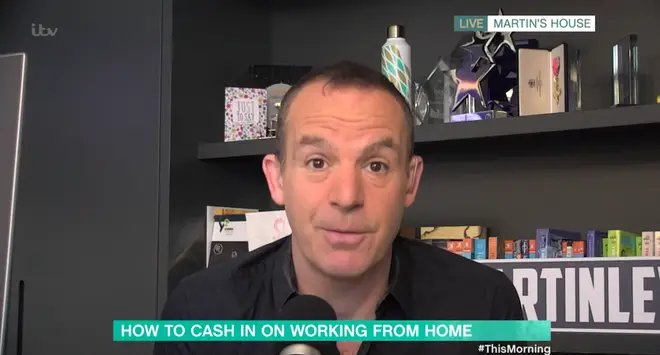

Martin Lewis reveals how employees can claim up to £240 for working from home

15 April 2021, 11:58 | Updated: 15 April 2021, 12:31

Martin Lewis explains how you could claim up to £240 if you've been working from home

Martin Lewis has revealed how to claim back money off tax for working from home during the pandemic.

Martin Lewis has given an update on how to claim up to £240 tax relief for working from home during the pandemic, following the news that the scheme has been extended into the new tax year.

Read more: Brits to bask in 15C sunshine on first weekend of pub gardens reopening in England

The tax relief is available to any employees who have been required to work from home, and have incurred extra expenses like heating and electricity while spending more time in the house.

For information on how to claim tax relief, visit gov.uk

Anyone who is eligible can have £6 a week of their current salary tax-free, which equates to £1.20 tax relief for those in the 20 per cent bracket, or £2.40 a week for those in the 40 per cent bracket.

Speaking on This Morning today, Martin said that there had been a change in the way the tax relief is operating - and that anyone who had worked from home at all, even for just a day, can claim an entire year's worth of tax relief.

He said: "It used to be you claimed for each week you had to work from home, but during the middle of last year I was quite shocked that HMRC had launched a micro service."

Explaining what that means, he said: "even if you worked from home for one day, it automatically gave you the entire year's tax relief."

Martin added that he had asked HMRC if it was a mistake, but was told that it wasn't.

He also revealed that the scheme had been extended into the new tax year (beginning April 6), meaning people can claim for two years of working from home if they are eligible.

Read more: Fury after pubs hit with no-show customers in first week of reopening

This means that many employees who have worked from home in the two tax years will be entitled to £120 off their tax (if they are in the 20 per cent bracket), but that some people will be eligible for up to £240 off.

Speaking about people who can claim relief, he said: "You don't need proof (of extra expenses), it’s a flat fee, as long as you have been required to work from home and had extra expenses you can claim this."

Explaining how it works, he continued: "So what that means now - if you didn't claim last year, and even if you've only been required to work from home for one day, you can claim tax relief, if you’ve done last year’s, you have to go back and claim this year’s."

Martin added that there would be "120 quid for pretty much any tax payer minimum if you do two years now."

NOW READ:

People over 45 can now book coronavirus vaccines in England