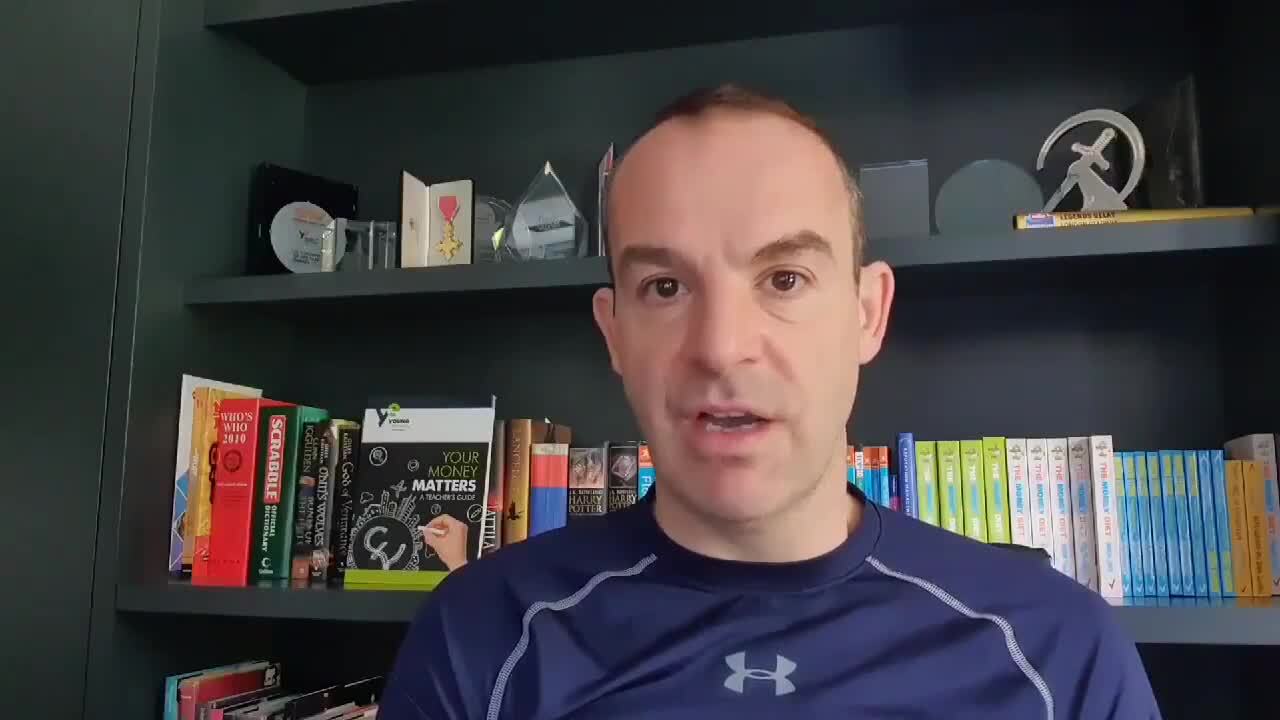

Martin Lewis explains how workers who have been shielding can claim £125

23 October 2020, 10:13

The Money Saving Expert opened had some advice for viewers on Thursday night.

Martin Lewis has explained how those who have had to work from home can get £125 from the government.

Employees have been able to claim the tax relief for months, but HMRC have now made it even easier and it now takes minutes.

And workers can also get the £125 payment even if they have only worked from home for one day since April.

Martin said on the ITV Money Show this week: "There’s been a huge change,"

"This is for employees that are required to work from home and it can help pay for expenses such as heating.

"From now on you can get a year’s tax relief even if you have only worked from home one day since April 6."

One viewer asked: "Does HMRC's tax relief include shielders?"

Read More: Martin Lewis explains why you shouldn't leave the heating on low all day

To which the financial expert replied: "If your employer or the government requires you to work from home, you can claim the support.

"If you have chosen to work from home, you cannot claim it.”

Another viewer also wrote in: "Me and my husband are both working from home, can we both claim the allowance?"

And Martin responded: "Yes, if you've both been told to work from home, you can.”

Martin Lewis issues important advice to the self-employed

The money could previously be claimed from your employer and is designed to cover extra costs that could occur with working from home including heating and WiFi.

How to claim

You are eligible if you've been ordered to work from home by your company or government guidelines.

However, if you are shielding out of choice, you won’t be able to claim.

Taxpayers can claim relief based on the rate at which they pay tax. To do this you need a Government Gateway user ID and password.

Apply here and once the application has been approved, your tax code will be adjusted and you'll receive the tax relief through your salary.