Martin Lewis council tax reduction - how to check you're paying for the right band

26 June 2024, 12:11 | Updated: 26 June 2024, 12:21

The Money Saving Expert could save you hundreds of pounds on your council tax bill by checking on your band. Here's how you can do it without a fuss plus all the other discounts you may be eligible for.

Listen to this article

Martin Lewis has revealed an easy and simple way to check your house council tax band which could save you hundreds of pounds in household bills.

Speaking on Good Morning Britain, the Money Saving Expert explained hundreds of thousands of homes across the UK are believed to be in the wrong band so if you check, you could be entitled to a reduction in the monthly bill you pay.

Not only that but Martin, 52, shared a list of council tax discounts you may not be aware of, helping you save even more a month on the regular outgoing.

So how can you "check and challenge" your council tax band? And what are the council tax discounts that are available? Here's all the advice.

How do you check and challenge your house council tax band?

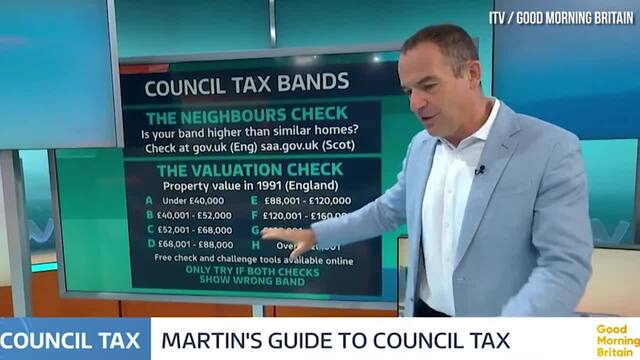

Revealing his guide to council tax, Martin Lewis said there are two ways in which to check you are eligible for a reduction. The first being the neighbours check and the second being the valuation check.

Explaining the neighbour check, he said: "Find a similar, or ideally identical property in your street and you check your council tax band compared to theirs. You can see all council tax bands on gov.uk in England. If you are in a higher band than your neighbours then that's your first tick."

- READ MORE: Martin Lewis explains new tax rule for anyone with an online 'side hustle'

- READ MORE: What has Martin Lewis said about student loans? How one million people could be owed money

Martin then recommended you should always do the second check too - the valuation check. He explained you need to work out what your property was worth in 1991 as this was when many homes were put in the wrong category originally.

This can be tricky but there are free check and challenge tools available online to help you with this like his one on moneysavingexpert.com.

He added: "The reason you need to check both these things is because there is a chance all your neighbours are in too low of a band and if you ask the list to be checked, there is a chance their band will be put up which will not make you very popular with the neighbours."

Martin explained that while the valuation check can't be used as evidence to lower your tax band, it does mean you'll avoid upsetting the neighbours.

Martin Lewis reveals tips to change your council tax band

What should you do if you are in the wrong council tax band?

At this stage, Martin gives a specific warning on his website to make sure you challenge your band with evidence.

He writes: "Challenging your band is not something to do speculatively without the checks, for one simple reason: You can't just ask for your band to be lowered – only for a 'reassessment', which means it could be moved up or down.

"This is why it is crucially important you do BOTH of the checks, and to be especially careful if you've added an extension or something that increases your property's value."

If you are ready to challenge your council tax band, the gov.uk website explains how to get in touch.

What council tax discounts are there?

On a separate note, Martin revealed there are also a number of discounts you can get which could save you thousands of pounds each year.

Firstly you could be entitled to money off your council tax if you are:

- A single person living in a household (with under 18s, alone or with live-in carers)

- A single person living with a student(s) or an adult with SMI (serious mental health)

- A single person living with an SMI adult and live-in carer

- A single person living with SMI adults and students

If you are an SMI adult living with a carer or students, and there is no eligible adult, then you could be entitled to 50% off.

If you are a student, or SMI adult living alone or with under 18s, you are also entitled to a huge council tax reduction.

Under 18s, students, SMI adults and live-in carers are all disregarded for council tax.

You can also get reductions based on your income so if you have a low wage or claim certain benefits like Universal Credit, you may also qualify.

Check Martin Lewis's full page on council tax discounts here for further ways you may be entitled to money off.

READ MORE:

- TV licence: How much is it rising by and when will the cost change?

- Car tax increases 2024: Rates and how much drivers will be paying revealed

- What is a triple lock pension? Your simple explanation to the new state pension changes