Martin Lewis reveals 'little-known' benefit for grandparents who help with childcare

11 October 2022, 12:48

Money Saving Expert Martin Lewis has shared a tip which could add thousands to grandparents' pensions.

Martin Lewis has revealed a benefit that could mean grandparents providing childcare could add thousands of pounds to their pension.

The Money Saving Expert shared a post about Specified Adult Childcare credits, which can be claimed by family members who care for children under 12-years-old while their parent is working.

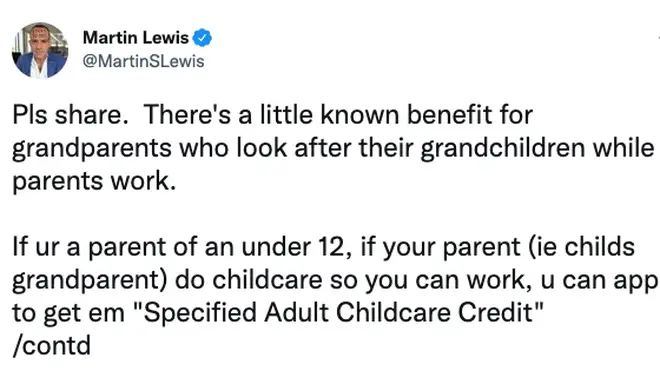

Taking to Twitter, the 50-year-old said: “Pls share. There's a little known benefit for grandparents who look after their grandchildren while parents work."

- Martin Lewis reveals 'easy trick' to get £175 by spending just £2

- Martin Lewis explains how to get free food from Tesco, Greggs and McDonalds

“If ur a parent of an under 12, if your parent (ie childs grandparent) do childcare so you can work, u can apply to get "Specified Adult Childcare Credit.”

"This means they get the National Insurance years that normally go to a parent who is off work looking after children (as you're working you'll usually be getting from work). This can add £1,000s to a state pension."

What are Specified Adult Childcare credits and how do they work?

Specified Adult Childcare credits work by transferring the National Insurance credit attached to Child Benefit from the Child Benefit recipient to a family member who is providing care for a child under 12.

These credits can then help build an entitlement to the State pension and can also help to stop gaps in your National Insurance record.

The benefit can also be backdated to as early as April 2011, according to the government website.

How to apply for Specified Adult Childcare credits

To apply for the benefit, you must meet the following criteria:

- you are a grandparent, or other family member caring for a child under 12

- you were over 16, and under state pension age when you cared for the child

- you are ordinarily resident in the United Kingdom

- the child’s parent or main carer is entitled to Child Benefit and has a qualifying year for National Insurance without needing the parent’s class 3 NI credits which they receive automatically from Child Benefit

To apply, you need to fill in an application form with details of the periods of care for the child.

Find out more about Specified Adult Childcare credits here.