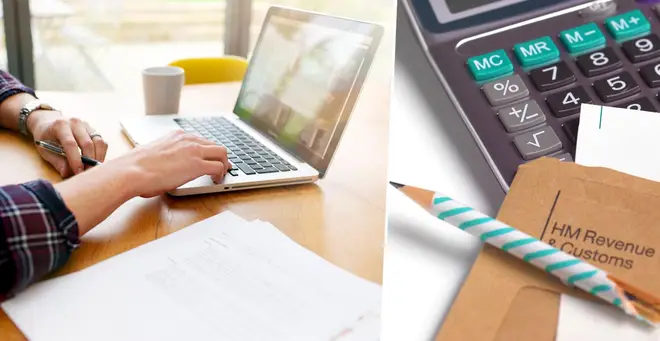

You can claim £6 a week tax back on extra costs if you're working from home

20 May 2020, 15:16

Find out how to claim tax relief on allowable expenses if you're working from home.

Despite the government easing lockdown rules last week, a large proportion of the country is still working from home.

While working from the comfort of your own house has some benefits, like not needing to commute and spending more time at home, many have found that it can also be expensive.

With added energy costs and extra office equipment, the costs can really add up.

But it turns out you could be eligible to claim tax relief for some of the bills you have to pay because you have to work at home on a regular basis.

How much can I claim?

First things first, you can only claim for things to do with your work, for example, business telephone calls or the extra cost of gas and electricity for your work area.

Read More: Matalan confirms full list of stores reopening this week in the UK

You can't claim for things that you use for both private and business use, for example, rent or broadband access, and you can't claim if you are choosing to work from home.

For one-off purchases, such as substantial equipment, you can claim back the full cost, or a pre-agreed flat rate.

For energy and broadband costs racked up while working from home, from 6 April 2020 you can get up to £6 a week or £26 a month. For previous tax years the rate is £4 a week (£18 a month).

Martin Lewis issues important advice to the self-employed

You can also try and work out the exact costs you're incurring by working from home, but you won’t get any more than the flat rate.

How can I apply for tax relief?

There are different ways you can claim, including online, by phone, or by post. You won’t need to keep any records unless you’re claiming for large items.

To apply online, you will need your Government Gateway user ID, you will then be directed to form P87, which is used for tax relief claims for up to £2,500.

Note that you can't claim for large purchases such as a laptop using this form, and will need to contact HMRC directly and provide a copy of a receipt.

If your employer has already offered you money towards the costs of working from home, you can't claim again as they will have already claimed on your behalf.

Check the Gov.uk website for further information.

Now Read: McDonalds reveals full list of Drive-Thru's which re-opened today